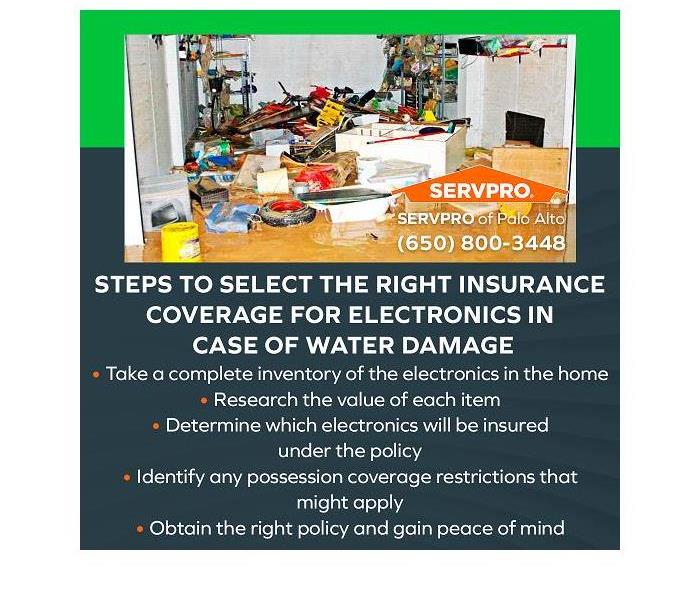

Five steps to select the right insurance coverage for water-damaged electronics in case of water damage

3/16/2023 (Permalink)

Blog Summary: SERVPRO of Palo Alto knows the importance of electronics in the home or business and the need for adequate policy coverage. These five steps will help the homeowner choose to cover the restoration or replacement of water-damaged electronics.

SERVPRO® of Palo Alto provides water removal for homes and businesses that have experienced water damage from a burst pipe, a flash flood, or other water damage disaster.

The selection process for choosing the best homeowners policy coverage for electronics can be challenging and confusing. The homeowner can choose a wide range of coverage limits, from a little to a lot. However, there is a pitfall the homeowner should be aware of. Policies that cover possessions, possessions insurance, might have restrictions on how much the policy pays for items of significant value.

Home electronics are a case in point. The rapid expansion in work-from-home scenarios has seen a corresponding increase in the quantity, quality, and cost of home electronics. An accurate assessment of the value of electronic devices that would be covered by a homeowners policy and the limits of the coverage deserve careful analysis. A catastrophic property damage disaster such as a fire, tornado, or flash flood could wipe out a home, the office in the home, and a small business based in the home. The right amount of coverage will ensure the house is cleaned up and restored.

The right coverage for electronics such as computers, copiers, and printers allows the homeowner, who is a remote worker or a small business owner working from home, to recover quickly and within budget. Here are some extra steps to ensure adequate coverage for electronics in the home, the remote home office, or the small business operating out of the home.

Step #1: Take a complete inventory of the electronics in the home

To be certain no device is overlooked, take an inventory. Go from room to room, making a list of everyone’s electronics. Look for the following items:

- Mobile phones

- Televisions & DVD players

- Stereo systems

- Computer equipment (including printers and scanners)

- Tablets

- Cameras

- Security systems

- Smart-Home devices

Do not be surprised if the list contains dozens of devices totaling thousands of dollars in value. The twenty-first century truly is the digital age.

Step #2: Research the value of each item

Start by looking at the receipt when the item was purchased. If the original purchase price is unavailable, determine the item’s current value by searching the internet. The original purchase price and the cash value (the value of the item after usage, the passage of time, and price declines in subsequent versions) can be significantly different. This price difference may influence the level of possessions coverage selected by the customer.

Step #3: Determine which electronics will be insured under the policy

The insured devices generally are the most expensive to replace or are crucial for business continuity and, therefore, need an immediate replacement for the home or business to continue functioning correctly and efficiently.

Step #4: Identify any possession coverage restrictions that might apply

The homeowners' policy may exclude certain electronics. These restrictions must be identified so the homeowner can decide whether to add the coverage. The worst time to discover a device is not covered is after it has been damaged or destroyed in a fire or flood.

A policy will not pay out in excess of its coverage ceiling. This payout limit can be reached very quickly if the replacement costs are very high. Powerful computers, 4K cameras, and stereo equipment can quickly bump against coverage limits.

Most policies will pay out cash value at the time of the loss. Other restrictions, such as a sub-limit for electronics, may apply. The total payout for all losses might be $50,000, but the payout for electronics may have a limit of $15,000 for electronics. Also, know what the deductibles are and how they apply.

Step #5: Obtain the right policy and gain peace of mind

Work with a reputable and trusted insurance agent to obtain the homeowners' policy best suits the circumstances.

Can electronics be cleaned up and restored?

SERVPRO of Palo Alto can provide expert electronics cleanup and restoration for electronics that have suffered fire damage, smoke damage, and water damage. Damage restoration is not recommended as a DIY project. The results could be shocking, cause a fire, or destroy the device.

When fire damage, smoke damage, or water damage disaster strikes, call the professionals at SERVPRO of Palo Alto. An IICRC-certified crew arrives on-scene in about an hour to begin the cleanup and restoration. When electronics are involved, every second counts. The longer the items are exposed to smoke, soot, and moisture, the more challenging the cleanup and restoration process will be. Consider pre-qualifying SERVPRO as the dedicated property damage restoration company for when a disaster strikes.

For more information about water removal services for residential or commercial properties like Apple Park, Cupertino, CA, call SERVPRO of Palo Alto at (650) 800-3448. The office can also be contacted by email at office@SERVPROpaloalto.com.

24/7 Emergency Service

24/7 Emergency Service